What is the meaning of QE1, QE2, QE3, QE4? What does it stands for and means in Finance, Money, Economics, Banking? What is the difference between QE1 and QE2 and QE3 and QE4?

Meaning of QEX? What is QEX? What does QEX mean? What does QEX acronym stands for? What is the definition of QEX?

Quite basically QEX stands for Quantitative Easing and the number tells the specific Quantitative Easing round/phase in question. The American Federal Reserve can stimulate the economy using any number of tools. Quantitative easing (QE1, QE2, QE3, QE4, QEX...) is one of them.The Federal Reserve can lower the interest rate. If the rate is lower, then banks will be more eager to lend money to other banks. If the rate is zero or .25% above zero then it is time to dig a little deeper into the tool box.

Meaning of QE1? What is QE1? What does QE1 mean?

QE1 stands for Quantitative Easing round/phase 1. The Wall Street Bailout. The stock market is falling. Sometime during the summer and early fall of 2008 the free hand of the market got burned. It stuck its hand into "complicated financial instruments that only a few people in the world understand" and got badly burned. The US Central Bank rushed in with socialized burn cream and handed its money to those in need (arguably, no doubt).Meaning of QE2? What is QE2? What does QE2 mean?

QE2 stands for Quantitative Easing round/phase 2. Right after Halloween in 2010 the US Federal Reserve decided that the US economy was not growing fast enough. It was growing... but not fast enough. Unemployment was over 9%, a few hundred banks had failed since 2008, the price of gold had soared, homeowners were underwater. Things were ok, but the Fed decided to give the recovery a little boost. So, they bought US Treasury Bonds (T-Bonds). Lots of them. And unlike QE1, QE2 didn't have any specific goal in mind, which means that yes - it was a success...Meaning of QE3? What is QE3? What does QE3 mean?

QE3 stands for Quantitative Easing round/phase 3, which is rumoured to take place after QE2, if situationally needed. Well, as of July 2011, nobody knows for sure what exactly QE3 means yet and obviously there is no official definition for QE3 either. Maybe the Federal Reserve will buy more US Treasury Bills (T-Bills). Or maybe they will bailout banks again like in QE1. Or maybe the Fed will..., oh what the hell. Nobody expects the US will ever pay back $14 trillion. So, go ahead raise the debt ceiling. What's another trillion or two? Go ahead S&P - downgrade our credit rating. QE3 will work, you'll see!Video updates: 9 Aug 2011

Here is one of the opinions regarding the probability of QE3:

S&P 'Dictating' Gov't Policy The Federal's Policy Statement has been released and according to it there won't be another round of quantitative easing (QE3). What we learned was that there will be no interest rate hikes until mid 2013, that the Fed has noticed that downside risks to the economic outlook have increased and that they may be prepared to use additional tools if warranted, and three members dissented from the decision. Is there anyone that can get us out of this mess? Business Insider's Joe Weisenthal weighs in on probability of QE3.

The QE3 issue closely relates to S&P downgrading US credit rating from AAA to AA+, to the stock market plunge and to the aftermath of all that. Here is a good overview of what's behind/ahead of us:

Gerald Celente: 'S&P downgrade is an Archduke Ferdinand moment' The stock market dropped dramatically today - the Dow plunged more than 600 points. Apparently the US lost it's triple a credit rating Friday - it was downgraded by S&P. The ratings agency downgraded Fannie Mae and Freddie Mac, which inspired the mainstream media headlines across the country. Gerard Celente of Trends Research Group answering the question, where is the country and the global economy heading to.

Video update: 26 Aug 2011

Ben Bernanke talked recently about the economic future and QE3. The news here was that really nothing new nor interesting was said. What does it mean? Will QE3 happen?

Ben Bernanke doesn't want QE3. For now According to recent reports the US economy grew 0.2% in the second quarter of this year. For a while now economists have debated if the US is in a recession or not. With these dreadful numbers, should the Federal Reserve intervene to try to save the economy or will they do more harm? Karl Denninger from the Market Ticker tells us what he thinks.

Video update: 31 Aug 2011

If you are interested in knowing the details about the current state of the crisis in both US and EU, the details about QE2, the political analysis and arguments for why Quantitative Easing didn't work, but why the QE3 (as well as QE4, QE5 etc) will probably happen, you should definitely check the following video. It is lengthy, but the amount of information and rational thinking provided is simply incredible!

CrossTalk: Bernanke 2.0 Why is Ben Bernanke being so vague about the Fed's policies? Does it really matter? Does the US have any tools (to be used in QE3) left in its toolbox? How relevant is the Fed, and when will the US economy start to recover? CrossTalking with Patrick Young, Martin Hennecke and Daniel Mitchell.

Update: 13 Sept 2012

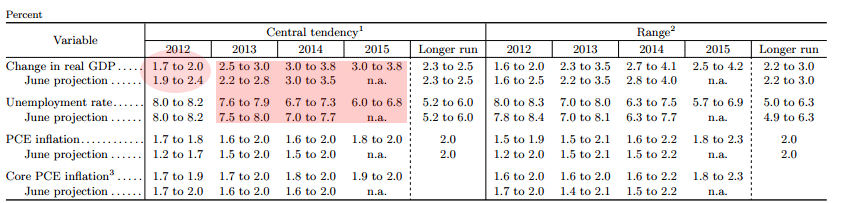

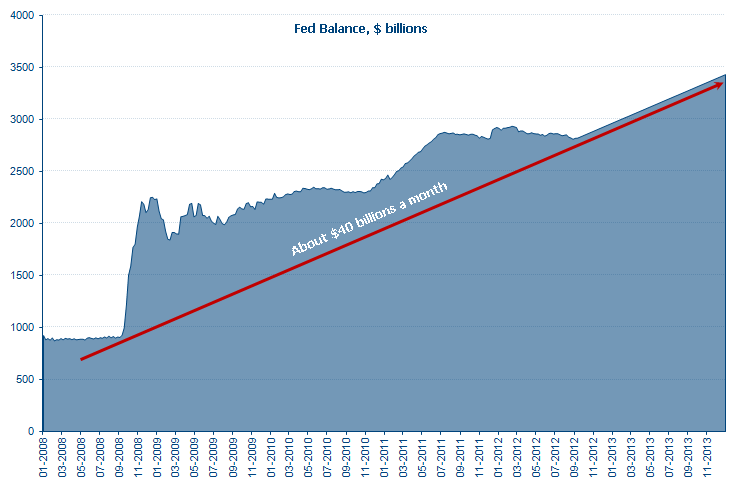

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month.Additionally to $40 billion a month, the old "Twist" program will also be continued, making the total balance of long-term papers $85 billion per month. Some papers were too fast reporting about the new $85b buys, but that's not true.

The number itself is not very significant, which would shut Republicans' critique a bit. But:

1. The Twist program continues. 2. The attitude change. Now Fed doesn't limit their involvement for a specific time only, but tells that it will buy as long and until it sees some significant and stable improvements in a job market, also leaving the option of increasing the amounts of spent money.

To compare, QE2's size was $75 billion a month, but it was for a specific amount of time and specific amount of money only.

If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability.This means, that FED is really to act even more agressively.

In particular, the Committee also decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015."End of 2014" -> "through mid-2015"

This is also pretty interesting:

Many still don't understand it, but today Fed clearly hinted that they are ready to be more agressive in their support of economics and more "loyal" towards the inflation (early this position was pretty clear when reading between the words).

I wouldn't call it QE3 (Quantitative Easing round/phase 3). It's more like QE∞ (Quantitative Easing round/phase Infinity). :)

They want decrease in unemployment and increase in employment... and the lowered dollar would be nice... but they can't get everything.

In all seriousness, they are doing the thing they know how to do, hoping that it would somehow miraculously help. They can't do anything else, but at least there is the activity and hope. :) That also answers the old question of "Can the 'monetarists' do anything else but increase the amount of money?". The correct answer is obviously "No. The are monetarists after all!". :) It's not the first year when Fed tries to balance between recession and inflation, but now they gave a signal, that they are willing to move their position toward employment in a hope...

Almost the whole QE2 went to Europe, but currently EU's liquidity is high and Fed tries to ignite the housing market, which started to give the signs of being alive.

Update: 16 Sept 2012

Meaning of QE4? What is QE4? What does QE4 mean?

QE4 stands for Quantitative Easing round/phase 4. But as of July 2011 nobody knows what exactly QE4 means. Nobody even knows if it even be needed. Who knows, maybe the economy will be in a such a great shape that QE4 won't be needed. Or maybe the economy will already be collapsing, US is defaulted and there will be nothing helpful to be done. Or maybe the politics (between Democrats and Republicans) will cause QE4, regardless of the actual meaning, not to be a viable option. Or maybe US Federal Reserve's chairman Ben Bernanke decide that QE4 is inefficient considering the current situation as a whole... Who knows, maybe there will even be QE5, QE6, QE7, etc...Additional reading

Want to know more about QE3 and other stuff? Read Wikipedia.=> Go to Economics and Banking Definition and Meaning Dictionary.